Refill & Reuse: What Brands Need to Know About this Evolving Landscape

Refillable packaging is trending, and for good reason. As Earth Overshoot Day (July 24, 2025) recently reminded us, we’re consuming more resources than the planet can regenerate each year. Add to that the fact that Amazon’s Prime Day (now several days) outpaced Black Friday in consumption by 2x (KUTV), and it’s clear: the systems of “take, make, waste” are still alive and well.

Refill and reuse schemes can offer an antidote to the tons of packaging waste that accompany the consumption of new products. Regulatory pressure, rising consumer awareness, and brand innovation are pushing brands to rethink how products are delivered and disposed of. Refill systems — once a niche sustainability initiative — are becoming a serious strategic consideration. But the refill landscape is complicated. Uptake varies dramatically by region, category, and a persistent “green gap” between consumer intention and action. For brands considering how (and whether) to launch a refill system, and for what products, success will require thoughtful consideration of market trends, sustainability imperatives, and brand fit.

The Refill Landscape

Packaging analysts Smithers forecast the refillable/reusable packaging market to grow 5% annually, reaching $53.5 billion by 2027 (Reuters, 2023). According to David Luttenberger, Global Packaging Director at Mintel, refill offerings in markets including Germany, the UK, the U.S., and France increased by as much as 279% between 2017 and 2023 (Beauty Packaging, 2024). Recent trends focus on in-store refill stations or specific products for refill programs (Ellen MacArthur, 2022). However, uptake challenges persist.

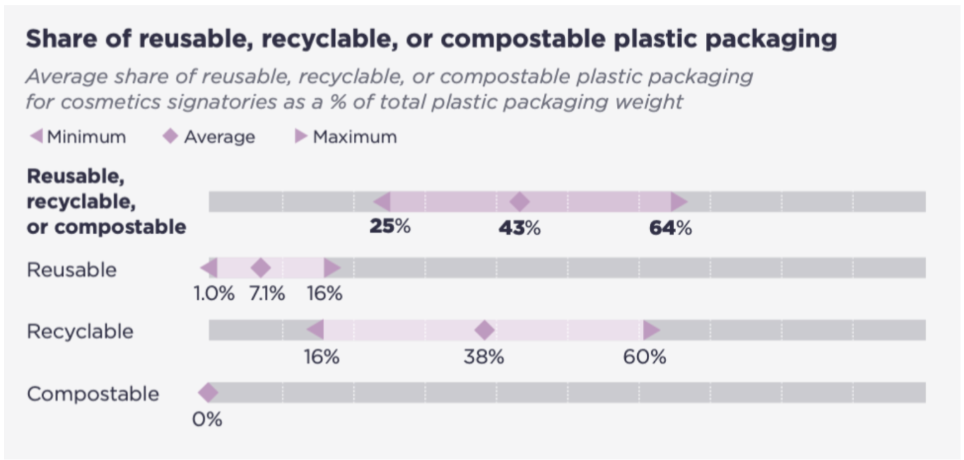

Graph: Ellen MacArthur, 2022

The Business Case for Reuse

According to the UN Environment Programme, scaling reuse systems — including refillable formats, take-back programs, and deposit-return schemes — has the potential to reduce plastic pollution by up to 30% by 2040. It’s also economically compelling: transitioning this circular economy could yield $1.27 trillion in net savings when factoring in recycling revenues and avoided waste management costs. However, realizing this impact requires strong policy support, and a compelling business case for a refill program. A full shift would require significant investment (approximately $65 billion USD per year), though that’s still more cost effective than continuing with the current linear model, which costs an estimated USD 113 billion annually. Well-designed Extended Producer Responsibility (EPR) frameworks can help offset costs —most of which are operational — ensuring producers finance the collection, recycling, and safe disposal of plastic products to keep circular systems functioning effectively.

Consumer Interest and Purchase Habits

Interest in refillable packaging is high. According to Trivium Packaging’s 2024 Buying Green Report, 71% of global consumers engage in reuse behaviors such as carrying refillable bottles or using reusable bags. In the U.S., 47% of consumers say they try to act in a way that is not harmful to the environment (Beauty Packaging, 2024). But turning interest into action is another story.

TerraCycle’s Loop program, launched in 2019, was slow to adopt with consumers (Reuters, 2023). Originally using a deposit-return model for durable packaging designed for up to 100 uses, hygiene concerns and return logistics became friction points. Loop ultimately shifted to a prefill model, sending products in reusable containers without requiring on-site returns. showed more promise with consumers. This approach has shown greater promise, particularly when consumers are able to buy and return anywhere, rather than being restricted to specific return points.

This intention-to-action gap was further validated with findings from a 2024 study by York University’s Circular Innovation Hub. North American consumers scored relatively high in stated willingness to try refillable formats (3.23 out of 5), their actual refill-seeking behavior was much lower (1.45). Concerns about hygiene, convenience, and packaging aesthetics were major barriers — especially in categories like beauty and personal care.

Program Adoption

Despite the challenges noted, several personal care brands have led the charge in refills:

Kiehl’s launched its “Don’t Rebuy, Just Refill” campaign, offering bestsellers in refill pouches (Sustainable Brands, 2024). Its Ultra Facial Cream refill uses 61% less plastic and can refill one jar three times. The brand aims to make 100% of products reusable, refillable, or recyclable by 2030. Maggie Kervick, Global Head of Sustainability at Kheils, has noted that their refill initiatives are proving fruitful in the U.S. market—not just in terms of sales, but also for deepening customer loyalty.

In 2022, The Body Shop introduced in-store refill stations in 49% of U.S. stores and is pursuing a global five-year rollout (Beauty Packaging, 2022).

L’Occitane offers refills in pouches and refill stations in select UK and Ireland stores (Harper’s Bazaar, 2023). In 2021, it eliminated 21% of plastic jars in favor of aluminum containers with 100% recycled caps (Ellen MacArthur, 2022).

Maggie Spicer, founder of Source Beauty ESG, notes that refill adoption is most successful with high-volume items of 12oz or greater, where the value to the consumer (price per ounce, environmental savings) is more immediately apparent.

Influencing Adoption

Across the board, convenience was cited as the most important factor (with the caveat that expected brand loyalty is also a key consideration (Reuters, 2023). Consumers are more likely to adopt refill systems that integrate easily into their routines (Packaging Digest, 2025), and where the refill offers tangible value that translates into cost savings or ease of use.

Brands that incentivize refills likely see greater engagement, especially when those promotions are tied to loyalty or cause-driven campaigns. As examples, Tata Harper’s 2024 Earth Month campaign gifted a refill pod with the purchase of any refillable skincare product, while The Body Shop incentivizes refills through a 20% discount (Harper’s Bazaar, 2023). These strategies help overcome inertia by offering immediate value to the consumer.

Consumer psychology also plays a critical role in the adoption of refill programs. Framing refill systems as a collaborative choice rather than a moral obligation increases consumer receptivity (Howe et al. (2021) and Sparkman et al. (2020). The messenger matters too. Authentic, relatable voices are more likely to influence behavior than traditional authority figures.

Conclusion

Refill systems are gaining momentum, but they’re not one-size-fits-all. For brands exploring refills, the most successful approaches will be:

Consumer-Centered: Designed for convenience, value, and low friction.

Emotionally Resonant: Framed as a habit, not a hassle.

Strategically Aligned: Integrated into broader packaging and sustainability roadmaps.

A smart entry point might include piloting refills for best-selling SKUs, conducting consumer listening sessions, or co-developing formats with manufacturing partners. Refills shouldn’t be treated as a trend, but as a potential tool to drive loyalty, reduce waste, and future-proof your packaging strategy.