Why Biodiversity Should Be on Every Brand’s Agenda

Biodiversity is fast emerging as a central business issue — one that will reshape how brands think about sourcing, resilience, transparency, and long-term growth. With COP 30 set to take place in the heart of the Brazilian Amazon in November 2025, both climate change and biodiversity loss will be main topics of discussion (SDG Knowledge Hub). Governments, financial institutions, and regulators are already moving toward biodiversity-related disclosures. For brands, the question isn’t if this topic will hit the boardroom, it’s when.

Nature Loss is a Business Risk

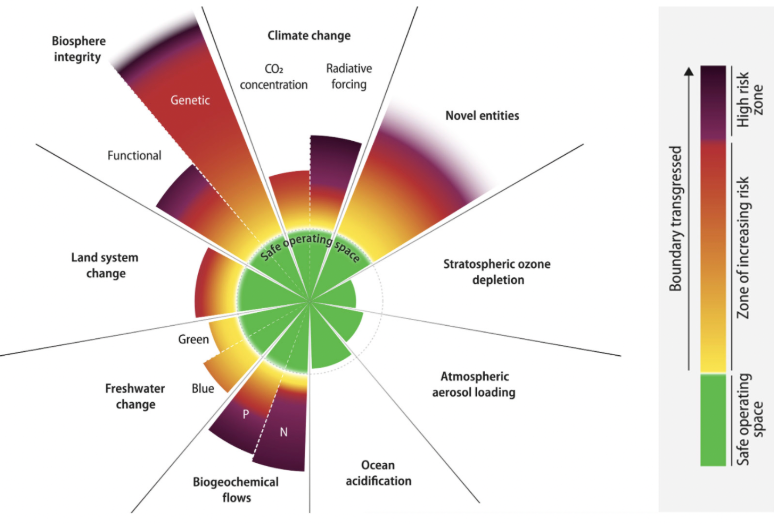

Nature provides vital services to both industry and humanity. From clean air and freshwater to the raw materials that supply global markets, nature is foundational to life on Earth. So much so, that over half the world’s total GDP is moderately or highly dependent on nature and its services, and yet a 2020 Global Risks Report by the World Economic Forum ranks biodiversity loss — and as a result, ecosystem collapse — as one of the top five threats humanity will face over the next decade. As of 2023, The Stockholm Resilience Centre reports that 6 of 9 planetary boundaries — including biodiversity — have already been breached. Biosphere Integrity (inclusive of biodiversity loss) presents a greater threat to humanity than climate change.

Image from Richardson, et al.

COP 30 and the Global Biodiversity Framework

In 2022, the Kunming–Montreal Global Biodiversity Framework (GBF) set a global ambition: to halt and reverse nature loss to achieve a nature-positive world by 2030 (Convention on Biological Diversity). The framework includes targets for restoring degraded ecosystems, reducing pollution, eliminating harmful subsidies, and ensuring that businesses disclose their biodiversity impacts. Within this framework, there is a stated expectation that companies are expected to play a direct role in achieving global targets.

At COP 30, hosted in Brazil’s Amazon region, expect biodiversity to take center stage — especially for industries with land use, ingredient sourcing, or water dependencies. Brand leaders who begin aligning now will be well-positioned to meet expectations, avoid greenwashing scrutiny, and take credible action.

The Business Case for Internalizing Nature Externalities

Biodiversity loss — along with greenhouse gas emissions, water use, and land use — is among the top 100 natural capital risks, costing the global economy an estimated $4.7 trillion annually, since 2009 (Trucost). Currently, no high-impact sector generates enough profit to offset its environmental footprint, underscoring the scale of nature-related externalities and the urgent need for new market-based mechanisms.

Tools for Nature-Based Accounting

Biodiversity Credits

Still nascent, biodiversity credits are an economic instrument that functions like carbon offsets, but funds ecosystem restoration and conservation (Think Landscape). Projects must be high-integrity, purchased though credible organizations, community-aligned, ideally recognizing Indigenous stewardship. Much like with carbon credits, biodiversity credits should be employed as a complement to an impact reduction roadmap, and not as a replacement (Biodiversity Credit Alliance). Organizations such as Pollination and the Biodiversity Credit Alliance help to ensure marketplace integrity and to review schemes.

Internal Pricing for Nature

Inspired by the rise of Internal Carbon Pricing, more companies are exploring an Internal Price on Nature (IPN): a voluntary, internal “tax” applied to nature-related impacts, incentivising departments to reduce their impact. Over 1,200 companies report using ICP, with 1,500 more planning adoption in the next two years, and more than half of the world’s largest firms now using ICP to drive emissions reduction and innovation (World Bank Group). Revenue generated from an IPN can be used to fund ESG initiatives and programming, or be expressed as a gradual increase to topline earnings of the company (One Earth). This approach sends a signal internally that nature has value, and helps finance future-proofing efforts across the business. Further, companies that take the lead on nature-positive action are more likely to resonate with increasingly values-driven consumers and investors. .

That said, challenges remain. Unlike carbon pricing, which has a standard unit of measurement monetizable per ton of CO₂e, biodiversity lacks a single, standardized unit of measurement (One Earth). Impacts vary widely by ecosystem, whether marine, terrestrial, or freshwater, and require context-specific data to assess. Developing meaningful baselines and consistent valuation methods is essential for IPN frameworks to gain traction.

Emerging Disclosure Frameworks

Frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) and Science-Based Targets Network (SBTN) help companies understand and report their nature-related dependencies and risks. The Kunming-Montreal Global Biodiversity Framework, as previously mentioned, outlines four overarching goals and 23 targets for achievement by 2030. While not a reporting framework itself, it sets the global ambition for nature-positive action, with which corporate initiatives are increasingly expected to align.

Supporting the adoption and operationalization of these frameworks, the World Business Council for Sustainable Development (WBCSD) acts as a business convening body — offering guidance, pilot programs, and cross-sector collaboration to help companies translate global frameworks and standards into actionable strategy.

Risks and Opportunities

The accelerating urgency of biodiversity loss presents both strategic risks and emerging opportunities for companies. Social and brand expectations are evolving rapidly. Consumers and investors increasingly expect companies to demonstrate “nature positive” action — not just in marketing, but in measurable outcomes.

Companies that fail to act may experience reputational damage or lose relevance in a values-driven market. Nature-related disclosure requirements are gaining traction across jurisdictions, and enforcement is likely to follow. The EU’s Corporate Sustainability Reporting Directive (CSRD) already includes biodiversity criteria.

Businesses that are unprepared may face compliance costs, legal liabilities, or fines. Finally, there is the fundamental material risk to business continuity. Companies depend on a stable environmental operating space, whether through access to clean water, pollination, fertile soil, or climate regulation. Overexploitation or degradation of these natural assets threatens long-term operational resilience and supply chain stability.

At the same time, opportunities are emerging for companies that lead. Early adoption IPN and participation in biodiversity credit markets can serve as risk mitigation tools while also enhancing brand equity and investor confidence. Market-based instruments offer companies a structured way to fund conservation, manage resource dependencies, and signal long-term leadership. Those who act now will be better positioned to shape the rules of engagement and unlock new forms of value creation.

Next Steps

As natural resources become more constrained, as a result of regulation and resource scarcity, companies that fail to internalize these costs will face mounting challenges. In contrast, companies that act now to bake nature-based costs into operations could gain a competitive advantage, enhance risk management, and build stakeholder trust.

The below steps can help your company set, measure and report on its biodiversity goals:

Identify your nature-related impacts and dependencies (e.g., land use, sourcing, water).

Establish a baseline, even if imperfect.

Explore internal pricing tools or “Earth Fees” to fund nature-positive work.

Engage with credible biodiversity credit partners to restore ecosystems.

Track evolving disclosure frameworks (TNFD, GBF, CSRD) and begin aligning.